Not much green: Cleantech VC funding in rapid decline

- Cromwell Schubarth

- Senior Technology Reporter- Silicon Valley Business Journal

- Email | Twitter | Google+

The highpoint was early in 2010,

around the time that President Barack Obama visited the

Fremont-based solar panel maker Solyndra. VCs poured a record $1.3 billion into

U.S. cleantech startups in the first quarter of that year.

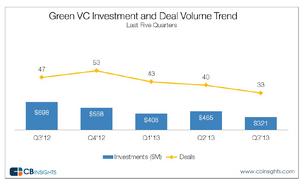

That dropped to about $321

million between July and September of this year, down 54 percent from the same

period last year, according to a report this week from CB Insights.

Most of the money and deals are going to later stage companies, with seed and

Series A funding in cleantech making up only about a quarter of the cleantech

deals and a third of the dollars in the most recent quarter. Those rounds

accounted for more than half the overall VC deals and dollars in the

quarter.

Almost half of the cleantech

deals and dollars was invested in California companies, led by the $55 million investment in Milpitas-based Solexel in

June.

Fourth quarter numbers could look

very different, too, thanks to a $103 million investment by Google in a Southern

California solar plant that was announced on Thursday.

A separate report this week called the pullback in cleantech venture funding

"a period of healthy correction after the 'irrational exuberance' of 2006 to

2009."

That quote comes from Cleantech

Group's annual global ranking of what it calls the 100 most innovative companies in the industry.

Kleiner Perkins Caufield & Byers has 19 companies

on the list, by far the most among venture firms and one of the few from Silicon

Valley whose cleantech portfolio hasn't shrunk. No. 2 VantagePoint Capital Partners has 7 in its portfolio,

down 2 from last year. Draper Fisher Jurvetson has just four, down from 9

last year. Khosla Ventures also had four, down from seven last

year.

Cromwell Schubarth is the Senior Technology Reporter at the Business Journal. His phone number is

No comments:

Post a Comment