|

In This Issue

|

|

|

|

|

Last Week in Review: After a several-week delay,

the Jobs Report for September was released. How did home loan rates react?

Forecast for the Week: A full week of reports is ahead, with news on

consumer spending, wholesale and consumer inflation, housing, and

manufacturing. Plus the Fed meets!

View: Do you consider yourself lucky? The answer to that question

may have more to do with your success than you may think. Learn why.

|

|

|

|

|

|

Last Week in

Review

|

|

|

|

|

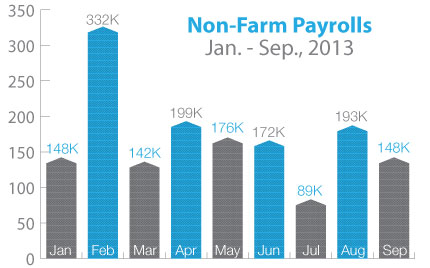

Better late than never. With the government shutdown

over, the Jobs Report for September was finally released--and the markets

and home loan rates reacted.

The Labor Department reported that

148,000 new jobs were created in September, below the 183,000 expected. For

July and August, the numbers were revised higher by a total of 9,000 jobs.

The Labor Force Participation Rate, a measure of how many people are

looking for work, was unchanged at 63.2 percent after falling in August to

a 35-year low. The Labor Department reported that

148,000 new jobs were created in September, below the 183,000 expected. For

July and August, the numbers were revised higher by a total of 9,000 jobs.

The Labor Force Participation Rate, a measure of how many people are

looking for work, was unchanged at 63.2 percent after falling in August to

a 35-year low.

The Unemployment Rate hit a 5-year low in September, falling to 7.2 percent.

This was fueled to some degree by workers entering retirement and those

Americans opting out of the workforce in a stagnant job market. And in the

latest Weekly Initial Jobless Claims Report, claims fell by 12,000 in the

latest week but still came in above expectations. The bottom line is that

we are simply not seeing any meaningful improvement in the labor market.

What did this mean for home loan rates? Remember that weak

economic news normally causes investors to move their money into safe

investments like Bonds. This includes Mortgage Bonds, to which home loan

rates are tied. We saw that dynamic in the markets last week, as Bonds

rallied after the weak Jobs Report was released, helping home loan rates

reach their lowest levels in four months.

Also still helping Bonds and home loan rates is the Fed's current

Quantitative Easing program, in which the Fed has been purchasing $85

billion in Bonds and Treasuries each month to stimulate the economy and

housing market. With key economic reports delayed due to the shutdown--and

with the September Jobs data weaker than expected--there is not much chance

the Fed will taper its purchases at its meeting this week. This should help

keep home loan rates attractive through the remainder of 2013.

The bottom line is that home loan rates remain attractive compared to

historical levels and now remains a great time to consider a home purchase

or refinance. Let me know if I can answer any questions at all for you or

your clients.

|

|

|

|

|

|

Forecast for the

Week

|

|

|

|

|

This week's economic calendar is packed with a number of

reports that will give investors a broad look at the U.S. economy.

- Right

out of the gate on Monday, Pending Home Sales will be released.

This will be followed by the S&P/Case-Shiller Home Price Index on

Tuesday.

- Also

on Tuesday, look for Retail Sales for September and Consumer

Confidence for October.

- A

double dose of inflation news begins Tuesday with the

wholesale-measuring Producer Price Index. The Consumer Price

Index follows on Wednesday.

- Wednesday

also brings the ADP Employment Report, followed by Weekly

Initial Jobless Claims on Thursday.

- Ending

the week, manufacturing data from the Chicago PMI and the ISM

Index will be released on Thursday and Friday, respectively.

In

addition, the next regularly scheduled meeting of the Federal Open Market

Committee is Tuesday and Wednesday, with the Policy Statement set to be

released Wednesday. Investors will be looking for any mention of when the

Fed may taper its Bond purchases, and this news could move the markets.

Remember: Weak economic news normally causes money to flow out of Stocks

and into Bonds, helping Bonds and home loan rates improve, while strong

economic news normally has the opposite result. The chart below shows

Mortgage Backed Securities (MBS), which are the type of Bond that home loan

rates are based on.

When you see these Bond prices moving higher, it means home loan

rates are improving -- and when they are moving lower, home loan rates are

getting worse.

To go one step further -- a red "candle" means that MBS worsened

during the day, while a green "candle" means MBS improved during

the day. Depending on how dramatic the changes were on any given day, this

can cause rate changes throughout the day, as well as on the rate sheets we

start with each morning.

As you can see in the chart below, Mortgage Bonds improved after the weaker

than expected Jobs Report for September, helping keep home loan rates

attractive. With a potential volatile week ahead due to the Fed meeting and

heavy economic report calendar, I'll be watching the news closely.

Chart: Fannie Mae

4.0% Mortgage Bond (Friday Oct 25, 2013)

|

|

|

|

|

|

The Mortgage Market Guide View...

|

|

|

|

|

|

|

|

Smart Success

5 Secrets to Creating Better "Luck"

"Luck is what happens when preparation meets opportunity."

Seneca

Richard Wiseman, psychologist and author of The Luck Factor, has spent years studying

serendipity--also known as luck.

In one experiment, Dr. Wiseman asked subjects, "Are you a lucky

person?" Yes or no.

Later on, he had each subject leaf through a newspaper to count the total

number of photos inside and report their answer. Unbeknownst to the

subjects, however, on the second page was a notice saying: "Stop

counting--there are 43 photos in this newspaper."

The result? Subjects who had answered "yes" to the luck question

tended to see the notice, stop counting, and report the correct answer.

Those who answered "no" tended to either miss the clue completely

or dismiss it as a trick, continuing to count.

Here is where Wiseman discovered a key principle of success: People who

consider themselves lucky are simply more open to already existing

opportunity.

Here are five more success principles for creating luck in your life:

Opportunity is where you look. Seeing opportunity is less about

"right place, right time" than it is about keeping your eyes

open. If you don't expect opportunity everywhere, you don't look for it,

and never see it coming--or going.

Try hard...but not too hard. While we all tend to associate unflinching

determination with high-achievers, staying loose--even straying off

course occasionally--attunes you to see more opportunities than does rigid

focus.

Set the goals, not the road. Opportunity favors a relaxed approach.

Once you've clarified the outcome you want, be open to the countless paths

to its achievement.

What failure? Fear of making a mistake is a crippling habit. Flip

your fear, and learn to see failure as a process of arrival--a

learning opportunity in and of itself.

Try something new much more often. Playing it safe all the time is a

recipe for regrets. The serendipitous tend to be fearless about

discovery--even if it's not the outcome they want to hear. So, instead of

wondering what could have been, go and find out!

Let your luck rub off on somebody! Feel free to pass these tips along

to your team, clients, and colleagues.

Economic Calendar for the Week

of October 28 - November 01

|

Date

|

ET

|

Economic Report

|

For

|

Estimate

|

Actual

|

Prior

|

Impact

|

|

Mon. October 28

|

10:00

|

Pending Home

Sales

|

Sept

|

NA

|

|

-1.6%

|

Moderate

|

|

Tue. October 29

|

08:30

|

Retail Sales

|

Sept

|

-0.1%

|

|

0.2%

|

HIGH

|

|

Tue. October 29

|

08:30

|

Retail Sales

ex-auto

|

Sept

|

0.2%

|

|

0.1%

|

HIGH

|

|

Tue. October 29

|

08:30

|

Core Producer

Price Index (PPI)

|

Sept

|

0.1%

|

|

0.0%

|

Moderate

|

|

Tue. October 29

|

08:30

|

Producer Price

Index (PPI)

|

Sept

|

0.2%

|

|

0.3%

|

Moderate

|

|

Tue. October 29

|

09:00

|

S&P/Case-Shiller

Home Price Index

|

Aug

|

NA

|

|

12.0%

|

Moderate

|

|

Tue. October 29

|

10:00

|

Consumer

Confidence

|

Oct

|

NA

|

|

79.7

|

Moderate

|

|

Wed. October 30

|

08:15

|

ADP National

Employment Report

|

Oct

|

NA

|

|

166K

|

Moderate

|

|

Wed. October 30

|

08:30

|

Consumer Price

Index (CPI)

|

Sept

|

0.1%

|

|

0.1%

|

HIGH

|

|

Wed. October 30

|

08:30

|

Core Consumer

Price Index (CPI)

|

Sept

|

0.1%

|

|

0.1%

|

HIGH

|

|

Wed. October 30

|

02:00

|

FOMC Meeting

|

Oct

|

NA

|

|

0.25%

|

HIGH

|

|

Thu. October 31

|

08:30

|

Jobless Claims

(Initial)

|

10/26

|

NA

|

|

NA

|

Moderate

|

|

Thu. October 31

|

09:45

|

Chicago PMI

|

Oct

|

NA

|

|

55.7

|

HIGH

|

|

Fri. November 01

|

10:00

|

ISM Index

|

Oct

|

NA

|

|

56.2

|

HIGH

|

|

|

|

|

|

|

test

test test

|

The material

contained in this newsletter has been prepared by an independent

third-party provider. The content is provided for use by real estate,

financial services and other professionals only and is not intended for

consumer distribution. The material provided is for informational and

educational purposes only and should not be construed as investment and/or

mortgage advice. Although the material is deemed to be accurate and

reliable, there is no guarantee it is without errors.

As your mortgage professional,

I am sending you the MMG WEEKLY because I am committed to keeping

you updated on the economic events that impact interest rates and how they

may affect you.

is the copyright owner or licensee of the

content and/or information in this email, unless otherwise

indicated. does not grant to you a license to any content, features or

materials in this email. You may not distribute, download, or

save a copy of any of the content or screens except as otherwise provided

in our Terms and Conditions of Membership, for any purpose.

You received this

email as a result of your ongoing business relationship with Michael Magnabousco.

While beneficial to a wide audience, this information is also commercial in

nature and it may contain advertising materials.

UNSUBSCRIBE: If you

would like to stop receiving emails from Michael Magnabousco, you can

easily unsubscribe.

Copyright 2013.

PlatinumPro Marketing.

|

|

INSTANT AFFORDABLE PERSONAL/BUSINESS/HOME/INVESTMENT LOAN OFFER WITHOUT COST/STRESS CONTACT US TODAY VIA Whatsapp +19292227023 Email drbenjaminfinance@gmail.com

ReplyDeleteHello, Do you need an urgent loan to support your business or in any purpose? we are certified and legitimate and international licensed loan Company. We offer loans to Business firms, companies and individuals at an affordable interest rate of 2% , It might be a short or long term loan or even if you have poor credit, we shall process your loan as soon as we receive your application. we are an independent financial institution. We have built up an excellent reputation over the years in providing various types of loans to thousands of our customers. We Offer guaranteed loan services of any amount to people all over the globe, we offer easy Personal loans,Commercial/business loan,Car loan Leasing/equipment finance, Debt consolidation loan, Home loan, ETC with either a good or bad credit history. If you are in need of a loan do contact us via Whatsapp +19292227023 Email drbenjaminfinance@gmail.com

Share this to help a soul right now, Thanks