|

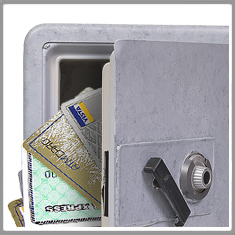

Credit Protection: Do it Yourself or Call in

the Pros?

There seems to be a lot of credit protection companies

popping up recently that promise to help you lock down your credit information

and protect your identity. And while these services can be valuable and worth

the subscription fees and cash guarantees, there are steps proactive consumers

can take to protect their personal credit information and save a few bucks in

the process – if they’re up for the challenge. The following are a few pros and

cons of both options. There seems to be a lot of credit protection companies

popping up recently that promise to help you lock down your credit information

and protect your identity. And while these services can be valuable and worth

the subscription fees and cash guarantees, there are steps proactive consumers

can take to protect their personal credit information and save a few bucks in

the process – if they’re up for the challenge. The following are a few pros and

cons of both options.

Fraud Alerts – The main step credit

protection programs take is to activate a fraud alert on your credit profile at

all three major credit bureaus: Equifax, Experian, and TransUnion. This action

alerts creditors that they must verify your identity before opening any credit

accounts, making it much more challenging (although not impossible) for any

credit accounts to be opened in your name. The good news is you don’t have to

pay a company to do it for you. You can activate a fraud alert on your own

credit reports for free. The problem, however, is that fraud alerts are

temporary and have to be renewed at each of the three main bureaus for each

person in your family, depending on which type of alert you activate. This can

be difficult to manage if you don’t stay on top of the

deadlines.

Currently there are three types of fraud alerts: A three-month

fraud alert, which is the main service credit protection companies provide to

you for a fee. For active military consumers, there’s a one-year fraud alert.

And, if you can prove that your identity has been stolen, you may be eligible

for a seven-year fraud alert. To create one of these fraud alerts that best fits

your needs, contact the three main credit bureaus for more info: Equifax:

1-888-766-0008 or visit www.equifax.com; Experian: 1-888-EXPERIAN (397-3742) or www.experian.com; and

TransUnion: 1-800-680-7289 or www.transunion.com.

Opt Out List –

After placing a fraud alert on your credit profile, the next step is to

request that your name be removed from all pre-approved credit offers and junk

mailing lists. Credit protection companies will likely do this for you as part

of their paid service, but you can do it yourself by calling 1-888-5-OPTOUT

(1-888-567-8688) or you can go to https://www.optoutprescreen.com.

Free Credit Reports

and Monitoring – This is where credit protection companies really earn their

money. While you have the right to a free credit report from each of the three

credit bureaus once a year, all subsequent credit reports will cost you. For a

lot of consumers, monitoring their credit report once a year is simply not

enough, and credit protection companies that provide more frequent monitoring

options as part of their service can create a peace of mind well worth the

subscription fee. To get your free annual report, visit www.annualcreditreport.com.

No Guarantees – The

biggest value of credit protection companies is a cash guarantee. After all,

when it comes to credit protection, there is no single method to avoid identity

or credit theft 100% of the time. With this in mind, some credit protection

companies offer a cash guarantee up to a certain amount to fix the errors caused

by the failure of their services.

Ultimately, it’s your responsibility to

protect your credit. And while there are steps you can take to do it yourself,

remember one thing: There’s no shame in calling in the

pros. |

no credit check loans with guarantor have an immense effect on instantaneous requirements without waiting for an elongated time. Moreover, there is no decision of approval based on previous arrears or debts. Thus, the borrower is relieved from such a worry. His appeal will not be turned down even if he has entered in the bad books of other banks.

ReplyDelete6 month money loans

6 month short term loans bad credit

cash loans for 6 months

When it comes to perfect Basins And Pedestals for our homes, which are often very suspicious that it is difficult, time consuming and expensive decision, but there are a variety of forms, and aspects that can be considered to give a better chance if the achievement Ideal bathroom next to you wanted.

ReplyDeleteFor More Detail us at: http://www.ukbathroomhub.co.uk/toilets-basins.html

It is exciting to imagine Patiala Suits Buy Online asked the reinvention of popular ethnic wear. Suits emerged as one of the major trends that ethnic wear framework, increasing ease of use and offer great variability in the shade.

ReplyDeleteMore Details: http://www.nituwears.co.in/punjabi-suits.html