Several people have asked me about a comment from

Fannie Mae chief economist Doug Duncan as quoted in a NY Times article a couple

of weeks ago: In a Shift, Interest Rates Are Rising “There’s no strong

correlation between interest rates and home...

22 hours ago

- C

House Prices and Mortgage Rates

by Bill McBride on 6/26/2013 05:20:00 PMSeveral people have asked me about a comment from Fannie Mae chief economist Doug Duncan as quoted in a NY Times article a couple of weeks ago:“There’s no

strong

Duncan is correct.correlation between interest rates and home prices,” said Douglas Duncan, chief economist at Fannie Mae.

However, a key difference now compared to earlier periods, is that there is more investor buying. And investors will compare their returns on different investments - and rising rates will probably slow investor demand for real estate, even if they are all cash buyers. But, in general, I think rising rates might slow price increases but not lead to a decline in prices(we might see some seasonal declines).

I'll post some more thoughts on the relationship between houseprices and interest rates (long term readers might remember I wrote about this in 2005), but first I'd like to post a couple of graphs.

Click on graph for larger

image.

Click on graph for larger

image.

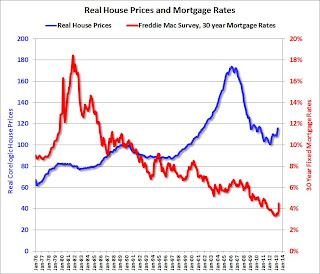

The first graph shows the Corelogic House Price Index (started in 1976) and 30 year fixed mortgage rates as reported by Freddie Mac in their weekly Primary Mortgage Market Survey® .

Even with mortgage rates rising sharply in the late '70s, house prices continued to increase. And there were a few spikes in interest rates (like in 2000) that didn't slow price increases. The second graph shows the same data,

but with house prices in real terms (adjusted for inflation).

The second graph shows the same data,

but with house prices in real terms (adjusted for inflation).

Real prices were fairly flat in the late '70s and early '80s ... so maybe the spike in interest rates slowed price increases ... and then the economic weakness in the early '80s kept prices from rising even as mortgage rates declined.

In the early '90s, economic weakness (and the unwinding of a small housing bubble in certain states), lead to falling real prices even as mortgage rates declined.

The bottom line is other factors (like a stronger economy) have a bigger impact on house prices than changes in mortgage rates.

Last 10 Posts

- Jun 27 at 3:06 PM

- Freddie Mac: Mortgage Rates highest since July 2011

- Jun 27 at 12:29 PM

- Kansas City Fed: Regional Manufacturing contracted in June

- Jun 27 at 10:33 AM

- Personal Income increase 0.5% in May, Spending increased 0.3%

- Jun 27 at 10:06 AM

- NAR: Pending Home Sales index increased in May

- Jun 27 at 8:36 AM

- Weekly Initial Unemployment Claims decline to 346,000

- Jun 26 at 9:59 PM

- Thursday: Personal Income and Outlays for May, Weekly Unemployment Claims

- Jun 26 at 5:20 PM

- House Prices and Mortgage Rates

- Jun 26 at 1:59 PM

- Philly Fed: State Coincident Indexes increased in 33 States in May

- Jun 26 at 11:46 AM

- Vehicle Sales in June forecast to be at highest level since 2007

- Jun 26 at 8:45 AM

- Q1 GDP Revised down to 1.8% Annualized Real Growth Rate

Last 10 Posts

- Jun 27 at 3:06 PM

- Freddie Mac: Mortgage Rates highest since July 2011

- Jun 27 at 12:29 PM

- Kansas City Fed: Regional Manufacturing contracted in June

- Jun 27 at 10:33 AM

- Personal Income increase 0.5% in May, Spending increased 0.3%

- Jun 27 at 10:06 AM

- NAR: Pending Home Sales index increased in May

- Jun 27 at 8:36 AM

- Weekly Initial Unemployment Claims decline to 346,000

- Jun 26 at 9:59 PM

- Thursday: Personal Income and Outlays for May, Weekly Unemployment Claims

- Jun 26 at 5:20 PM

- House Prices and Mortgage Rates

- Jun 26 at 1:59 PM

- Philly Fed: State Coincident Indexes increased in 33 States in May

- Jun 26 at 11:46 AM

- Vehicle Sales in June forecast to be at highest level since 2007

- Jun 26 at 8:45 AM

- Q1 GDP Revised down to 1.8% Annualized Real Growth Rate

Archive

FT Alphaville

- The Closer

- Market structure and the rate rise

- All the shale boom are belong to US

- Wall St boom, Main St bust

- The eurozone’s second sovereign restructuring, confirmed

Economist's View

- The Long-Term Budget Picture

- Inflation is Too Low

- Links for 06-27-2013

- 'Karicature Keynesianism'

- Central Banks: Powerful or Powerless?

Econbrowser

- Just how helpful is inflation?

- “Global Spillovers and Domestic Monetary Policy”

- The end of low interest rates

- The ECB's OMT and the German Constitutional Court

- Revisions in Expected Interest Rate Paths

Paul Krugman

- Non-inflation Denial

- The Better Angels of Our Nature (Off-topic)

- Karicature Keynesianism

- Aggregate Supply, Aggregate Demand, and Coal

- A Day At The Beach (Personal and Unimportant)

Economix

China Financial Markets

- How much investment is optimal?

- Excess German savings, not thrift, caused the European crisis

- Investment and consumption

- Feedback loops

- The challenges for China’s new leadership

Free exchange

- An unexploited resource

- Consider the dealership

- Whose low rates are these?

- Link exchange

- "We are not tightening", says a tightening Fed

macroblog

The Baseline Scenario

- Save If Failure Impending

- Want To Reduce the National Debt? Find More Workers

- New Research in Financial Regulation

Grasping Reality with Opposable Thumbs

- Immigration Reform Passes Senate 68-32

- Something Wrong with the Framing of CEO Pay in Steven Kaplan's Feldstein Lecture? Larry Mishel Makes a Good Case That It Is

- Mark Thoma: CBPP on the Long-Term Budget Picture

- Liveblogging World War II: June 27, 1943

- Does Allan H. Meltzer Look at Numbers?: Thursday Whiskey-Tango-Foxtrot-Bang-Query-Bang-Query Weblogging

Noahpinion

- I get what you get in ten years, in two days

- Some essential papers in behavioral finance

- Podcast: All about Abenomics

- Why I am a fiscalist

- What is "neoclassical" economics?

OilPrice.com Daily News Update

- Commodity Update: Open Interest Analysis for June 26th, 2013

- European Resistance to Gazprom is Futile

- Duke University Study Links Fracking to Ground Water Contamination

- Israel Approves 40% Gas Exports, But to Where?

- Natural Gas Discoveries in the Eastern Med Reignite Old Rivalries

Capital Gains and Games

- #cliffgate Will Be Boehner's Waterloo - Stan Collender

- Rosenthal Cartoon - Dan Rosenthal

- National Confidence Ratings For Congress Don't Matter When It Comes To The Budget - Stan Collender

- Instead Of Fiscal Cliff, Call It "Cliffgate" 2014 - Stan Collender

- About The S&P Upgrade: Yawn - Stan Collender

Beat the Press

- Niall Ferguson Tries to Promote Generational Warfare from the Land of the Excel Spreadsheet Error (Harvard)

- Nocera Largely Right on Fannie and Freddie

- Thomas Edsall on Richard Burkhauser and Inequality

- Honest Piece by Casey Mulligan on Medicaid Expansion

- The Huge Variance in Wages of Male College Grads Discourages College Enrollment

Housing Wire

- Mortgage debt levels decline among US consumers

- Agency MBS drops slightly

- GE Capital boosts lending as CMBS sector remains unstable

- Markets tumble on NY Fed chief's remarks

- FHFA reports 'irrelevant' to BofA MBS deal, investors say

The Big Picture

- 10 Thursday PM Reads

- The Corporate States of America

- Housing Recovery Elusive for U.S. Homebuilders

- 10 Thursday AM Reads

- Why I Write: Barry Ritholtz

Ezra Klein

- Immigration reform has passed the Senate. Here's how it passes the House.

- Lawyers said Bush couldn't spy on Americans. He did it anyway.

- Look out below! The price of gold is plummeting.

- The U.S. will stop financing coal plants abroad. That's a huge shift.

- The case for cutting the link between taxes and marriage

Felix Salmon

- Why Detroit’s art must stay

- Detroit takes aim at its pensioners

- Score the unscored!

- Counterparties: Unpaid internship

- Counterparties: Passing Abenomics

Note: the above links are from unaffiliated sites for reader convenience.

Note: the above links are from unaffiliated sites for reader convenience.In Memoriam: Doris "Tanta" Dungey

Blogroll: I'm receiving 100s of requests to be on the blogroll and it is completely out of control.

Right now the blogroll is frozen until further notice while I rethink the usefulness for the readers. Sorry.Thanks, CREconomic Sites

- A Dash of Insight

- Angry Bear

- Bonddad Blog

- Brad DeLong's Website

- Econbrowser

- Economic Logic

- Economist`s View

- Eschaton

- Financial Armageddon

- Hedge Fund Implode

- Hilo Living

- IMF Direct

- Insider News, Stocks, Brazil

- International Political Economy Zone

- Jesse's Café Américain

- Krugman: Conscience of a Liberal

- Macroblog (Dr. Altig)

- Mish's Global Economic Analysis

- Money is the way

- MV=PQ

- OilPrice.com

- Paul Krugman Archive

- Private Equity

- Robert Salomon, NYU Professor

- Rogue Economist Rants

- Stefan Karlsson's Blog

- The Big Picture

- The Economic Populist

- The Enlightened American

- W.C. Varones Blog

- Zacks

Housing Sites

- Chicago Mortgage Loans

- Housing Chronicles

- Housing Doom

- Investment Properties

- Irvine Housing Blog

- KeNo's Housing and Economic Portal

- Manhattan Beach Confidential

- Market Trends Alabama Real Estate

- Mortgage News Clips

- NJ Real Estate Report

- NY City Urbandigs

- Paper Economy

- Portland Housing Blog

- RE in the LBC, Long Beach, CA

- Real C'ville - The Bubble Blog

- Reverse Mortgage Lenders

- Sacramento Area Flippers In Trouble

- Sacramento Real Estate Statistics

- San Diego Housing Forecast

- San Fernando Valley Real Estate

- Santa Monica Distress Monitor

- Seattle Bubble

- UK Housing Bubble

- Westside Bubble blog

Resources

Read more at http://www.calculatedriskblog.com/2013/06/house-prices-and-mortgage-rates.html#EHLPikq0q8HoSWCI.99 lose viewer

No comments:

Post a Comment