Building wealth: Best moves if you're 25 to 34

Money magazine's 101 Ways to Build Wealth package offers blueprints for the different stages of your life on how to achieve real financial security. In tips #1 through #27, we offer advice for 25- to 34-year-olds.

WHAT YOU NEED TO KNOW:

Savings goal at age 30: 0.6 x your income

Biggest cash drain: Student loans and other debt

Biggest challenge: Overcoming fear of investing

Biggest opportunity: Lots of time for your money to compound

TIPS:

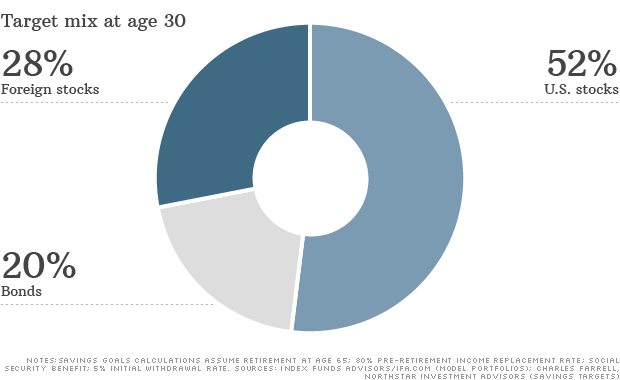

1. Be courageous. Nearly 40% of Gen Y-ers say they'll never feel okay investing in stocks, MFS Investment Management reports. Take note: Since 1926, a portfolio mostly in stocks has never lost money in any 20-year period while averaging gains of more than 10.8% a year, vs. 4% for bonds.

Get an age-appropriate mix with the target-date fund in your 401(k) or MONEY 70 picks Vanguard Target Retirement 2050 (VFIFX) or T. Rowe Price Retirement 2050 (TRRMX).

2. Go for a Roth 401(k). The Roth advantage: You save with after-tax dollars, so, unlike a regular 401(k), you won't pay income taxes on withdrawals. That's a good deal if you'll be in a higher tax bracket at retirement, as is the case for many young investors.

Four in 10 large plans now offer a Roth option, Aon Hewitt says. To hedge your bet on future tax rates, split your contributions between a Roth and a pretax 401(k).

3. Don't cash out. More than half of workers in their twenties who leave a job do not roll their 401(k) into an IRA or their new employer's plan, says Aon Hewitt. Bad move: On a $10,000 balance, you could be left with just $7,000 after taxes and penalties. If, instead, you keep that money growing at, say, 6% a year, you'll have an extra $100,000 or so by the time you retire.

NEXT: Favor cash-rich stocks

By Carla Fried, Paul J. Lim, Ismat Sarah Mangla, Donna Rosato and Penelope Wang @Money - Last updated April 16 2013 11:23 AM ET

No comments:

Post a Comment