The news keeps getting better for the U.S. housing market. Prices are up,

construction is up, and new-home sales are up. These are significant changes on

the margin that are likely to have positive ripple effects throughout the

economy.

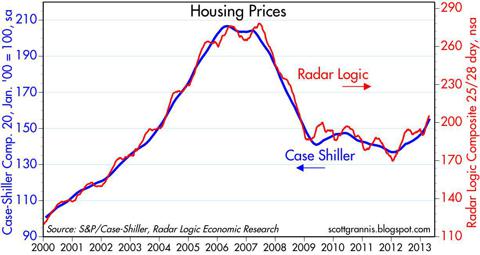

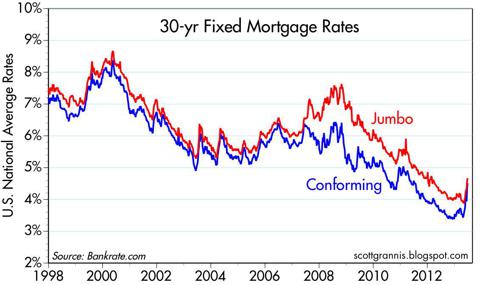

Both measures of housing prices show a 12% gain over the past year. Higher mortgage rates are likely to temper -- but not derail -- further price increases. Higher mortgage interest rates are a logical response to stronger demand for housing.

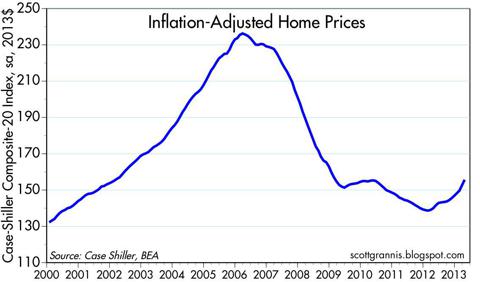

On an inflation-adjusted basis, prices have bounced off their lows of early 2012. This marks almost four years of price consolidation after three years of catastrophic declines. There is every reason to believe that we have seen the worst, and that the future for housing looks bright.

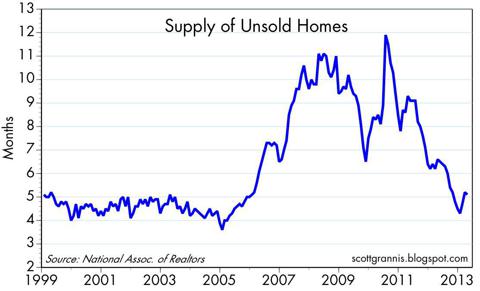

The supply of homes for sales is at very low levels, after being very high for most of the past seven years. There is no longer a glut of homes for sale; the market is now faced with a relative shortage of homes for sale, although there are signs that the inventory of homes for sale is rising. Rising prices are restoring equity to millions of homeowners that had been underwater.

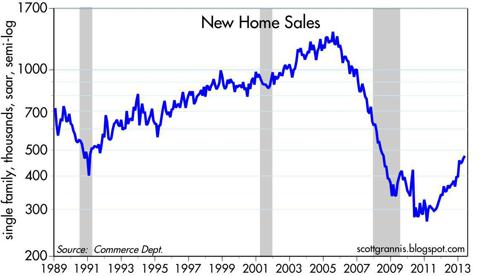

May new-home sales beat expectations (476K vs. 460K), and are up 75% from their lows. That's in line with the 90% increase in housing starts since the 2009 lows. It's reasonable to expect further gains, since construction is still very low from an historical perspective.

Both measures of housing prices show a 12% gain over the past year. Higher mortgage rates are likely to temper -- but not derail -- further price increases. Higher mortgage interest rates are a logical response to stronger demand for housing.

On an inflation-adjusted basis, prices have bounced off their lows of early 2012. This marks almost four years of price consolidation after three years of catastrophic declines. There is every reason to believe that we have seen the worst, and that the future for housing looks bright.

The supply of homes for sales is at very low levels, after being very high for most of the past seven years. There is no longer a glut of homes for sale; the market is now faced with a relative shortage of homes for sale, although there are signs that the inventory of homes for sale is rising. Rising prices are restoring equity to millions of homeowners that had been underwater.

May new-home sales beat expectations (476K vs. 460K), and are up 75% from their lows. That's in line with the 90% increase in housing starts since the 2009 lows. It's reasonable to expect further gains, since construction is still very low from an historical perspective.