5 Reasons Why You Can't Ignore Your Credit

Getty Images

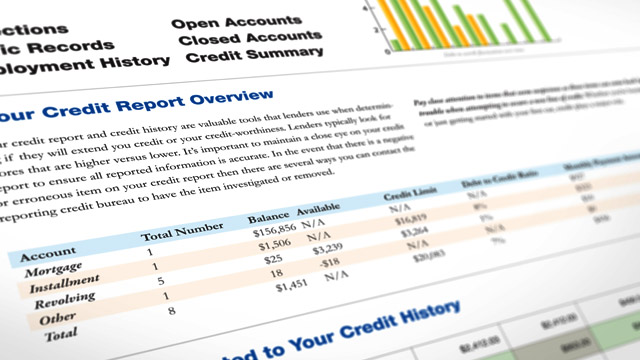

For most people credit still represents something that happens to us, rather than something we can build, nurture, manage and protect like an investment portfolio.

A lot of folks simply don't like the idea of credit or the fact that banks and other organizations collect information about us in order to determine whether or not we are worthy borrowers. It feels unfair -- like they are having conversations behind our backs, and when they make mistakes, it can be difficult to fix the problems.

Nevertheless, credit and the evolving system that shapes it -- whether it's the creation of new credit scoring models or the changing standards of lending institutions -- can either stifle or advance economic growth and is (for better or worse) a reality in our lives. While it is not impossible to live without a credit score, the unforeseen consequences of doing so can have a real impact, particularly for people in a crisis.

Consider these instances where having a credit history can enhance our lives:

| 1. You're not ready to buy, so renting is your only option. |

Many landlords check potential tenants' credit reports and scores before renting out an apartment. The practice is especially common for recent college graduates and young adults, whose incomes rarely equal 40 to 50 times the monthly rent, as some landlords require. Therefore, you may well have to:

- Put down a gargantuan cash deposit (perhaps 3-12 months).

- Find one or more roommates (whom you may or may not like).

- Convince a friend or family member with a fair amount of spare credit or assets to co-sign for you.

- Enroll in a rental guarantee program like Insurent, which charges between 75 percent and 110 percent of a month's rent. In New York City, where the average rent is $2,902 a month, that could cost you as much as $3,192. The average rent nationwide is $804 per month, which means a deposit program (if you could find one that covers rentals in your area) could cost the average renter an extra $884. Another company, RentSecure, blocks out enough money on your credit card to cover a half-year's rent. In Los Angeles, where the average monthly rent is $1,389, that could load your credit card account down with $8,334 in unusable credit, which then can't be used to buy necessities or cover emergencies. However, if you're a "cash-only" true believer you may not have a credit card, which means this option is not available to you anyway.

More on Credit.com: Can You Really Get Your Credit Score for Free?

| 2. You're in a financial crunch. |

More on Credit.com: The Ultimate Guide to Credit Scores

| 3. You want to take a vacation, rent a car or are dying to see the latest Bruce Willis movie. |

| 4. You need to find a job. |

| 5. You're tired of making money for everybody else. |

What to Do If You Need to Build Credit

No doubt, many people use credit like a 17-year-old, borrowing to the max and not worrying about the consequences. It's also possible to drive a car like a 17-year-old, flooring it all over town and occasionally ramming into people, but that doesn't mean no one should buy a car.

In adult hands, treated like an asset rather than a vehicle for irresponsible behavior, credit can be a powerful life enhancement and wealth building tool.

An auto loan can help us better afford a reliable car to drive to a better-paying job. A mortgage enables homeownership, which for most Americans has been the cornerstone of wealth and long-term financial stability. When paid promptly every month, credit cards can make it easier to track spending, earn rewards (even get cash back), build a more solid credit profile and help smooth out the ebbs and flows of income and expenses during times when cash is tight and running a balance is unavoidable.

More on Credit.com: 5 Credit Rules Everyone Should Follow

Every one of these life events, each representing another financial building block, is made more possible when you have a solid credit report and a good score. Building a strong credit history requires constant maintenance and attention lest it become a rap sheet and not a resume. (If you're not sure where your credit stands, you can use Credit.com's free Credit Report Card for a clear breakdown of the information in your credit reports, as well as your credit scores.)

Building good credit also requires that you spend responsibly; that you don't use credit cards like money because they're not money. Golden Rule: If the cash isn't there to pay for what you've charged, you'd best think twice before swiping. Our friend and cash-only guru Dave Ramsey is dead right about that, and many other things, but even he acknowledges that sometimes "life happens." Fact: Not everyone has a five-figure emergency fund, and for many people access to affordable credit is the difference between financial struggles and financial ruin.

Managing credit indeed requires hard work, but the payoff can lead to a richer and fuller life on a number of levels; pretending it doesn't exist limits our options.

Adam Levin is chairman and cofounder of Credit.com and Identity Theft 911. His experience as former director of the New Jersey Division of Consumer Affairs gives him unique insight into consumer privacy, legislation and financial advocacy. He is a nationally recognized expert on identity theft and credit.

'Make Love Not Porn': New Movement

Gaining Popularity

(ABC News Nightline Video)

'Neighbor From Hell' on Trial After

Being Caught on Tape

(ABC News GMA Video)

Photo Fad: Women Shed Clothes for

Special Occasions

(ABC News GMA Video)

'Make Love Not Porn': New Movement

Gaining Popularity

(ABC News Nightline Video)

'Neighbor From Hell' on Trial After

Being Caught on Tape

(ABC News GMA Video)

Photo Fad: Women Shed Clothes for

Special Occasions

(ABC News GMA Video)

Plastic Surgery Disasters: Lil Kim,

Meg Ryan & More

(Hollyscoop)

Walmart Canada’s new wheels turn

heads

(The Green Room)

30 Ugly Celebrities without

Makeup

(Celebrity Toob)

Plastic Surgery Disasters: Lil Kim,

Meg Ryan & More

(Hollyscoop)

Walmart Canada’s new wheels turn

heads

(The Green Room)

30 Ugly Celebrities without

Makeup

(Celebrity Toob)

-

Moonshiners Make a Big Mistake (Discovery)

-

The 1 Skill That Makes a Job Candidate Stand Out (OPEN Forum)

More from ABC News

Join the Discussion

You are using an outdated version of Internet

Explorer. Please click here to

upgrade your browser in order to comment.

You Might Also Like...

Video Shows You 'How to Fold a Shirt

in 2 Seconds'

(ABC News GMA

Video)

Fox News Sued for Airing Man's

Suicide on Live TV

(ABC News U.S.

Video)

Paula Deen's Awkward Apologies Over

Racial Comments

(ABC News GMA

Video)

15 Awesome pictures of Derek Jeter’s

Girlfriend

(Rant Sports)

Video Shows You 'How to Fold a Shirt

in 2 Seconds'

(ABC News GMA

Video)

Fox News Sued for Airing Man's

Suicide on Live TV

(ABC News U.S.

Video)

Paula Deen's Awkward Apologies Over

Racial Comments

(ABC News GMA

Video)

15 Awesome pictures of Derek Jeter’s

Girlfriend

(Rant Sports)

See It Share It

Most Commented

No comments:

Post a Comment